| | In today’s edition: Gemcorp establishes an operating unit in Dubai for African projects, and Saudi’s͏ ͏ ͏ ͏ ͏ ͏ |

| |  | | | Global Capital Edition |

| |

|

- De-risking African projects

- Gulf climate finance surge

- Africa mining deal collapse

- Saudi ‘savings circles’ app

- Abu Dhabi firm closes fund

Saudi luxury label hits Paris runway. |

|

Saudi Arabia’s liquidity challenges are increasingly presenting lucrative opportunities for foreign investors. Everyone from the government, the sovereign wealth fund, Aramco, and local lenders are tapping foreign investors to raise money. The total value of outstanding Saudi debt is set to cross $600 billion by the end of the year, with the kingdom set to remain one of the largest US dollar debt issuers in emerging markets, according to Fitch Ratings. It’s already been a busy January, with an average of $1 billion a day raised from a variety of issuers. To help soak up all this issuance, the kingdom is working to boost visibility and access among global debt investors. And it’s not just debt. The kingdom is making a renewed push to attract foreign equity investors too, and removed restrictions on who can buy shares on Feb 1. That is intended to help the market digest a growing IPO pipeline. Foreign direct investment has also been picking up momentum. “The kingdom has gone through the flat part of the S curve, we have planned and we have reformed,” Minister of Investment Khalid Al-Falih said last week in response to questions from Semafor. “Now we are climbing the vertical part of the S curve.” With the government budget in deficit, Public Investment Fund facing vast spending commitments, and domestic banks struggling to keep up with demands for loans, the kingdom will have to step up its efforts even more this year to attract more dollars into the economy. |

|

Gemcorp unit to focus on executing projects |

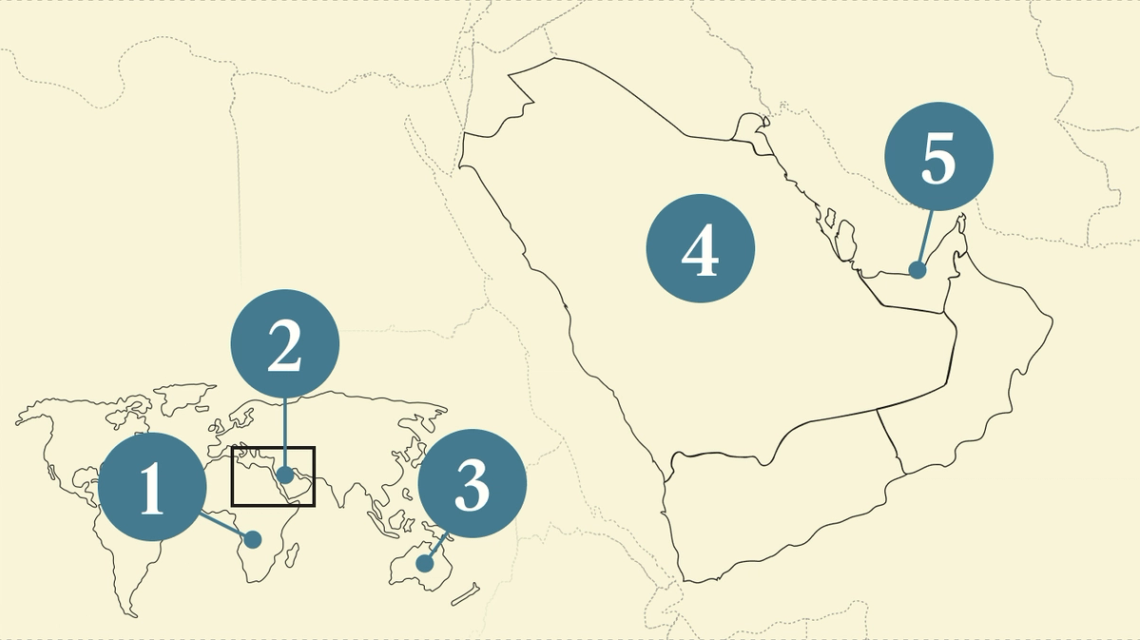

Ed Cropley/Reuters Ed Cropley/ReutersGemcorp Capital — an emerging markets investor that has deployed more than $9 billion, primarily in Africa — is consolidating some units to focus on executing projects. The new company, Imbono, will focus on solving a problem facing investors in Africa and other emerging markets: Projects that are financed but never fully delivered, its CEO Marcus Weyll told Semafor. Headquartered in Dubai, with Angola as its operational hub for Africa, Imbono will execute energy, water, logistics, and food security projects. The company will also look at opportunities in Latin America and Indonesia, in addition to its core African footprint, which includes the Democratic Republic of Congo, Ghana, Kenya, and South Africa. Gemcorp has been expanding its Gulf presence, raising Africa-focused funds out of Abu Dhabi and a Saudi-focused fund in Riyadh. It has partnered with Angola’s sovereign wealth fund on infrastructure vehicles targeting energy, water, food security, and critical minerals. These efforts are part of a growing Gulf-Africa investment corridor that has prompted a surge of announced commitments from the region to Africa in recent years. — Mohammed Sergie |

|

Gulf capital pours into African power |

Temilade Adelaja/Reuters Temilade Adelaja/ReutersClean-power investment from the Gulf into Africa is surging, but could have even greater impact were it targeted more towards power infrastructure, a new report argued. In particular, Saudi Arabia and the UAE have in recent years driven money into intermittent-renewable energy generation and hydrogen projects, according to Clean Air Task Force research shared first with Semafor. Riyadh and Abu Dhabi unveiled some $175 billion in funding pledges between 2010 and 2024, largely as investments rather than loans, which CATF noted was a friendlier form of financial relationship. But, CATF’s Director of Climate Policy Innovation David Yellen said, the two countries could make a greater impact — environmentally, economically, and geopolitically — if they shifted the focus of their state-linked funds to financing grid improvements and transmission infrastructure: “Our hope is that the sources of capital that can be more patient… go into projects that enable knock-on investment,” he said. — Prashant Rao |

|

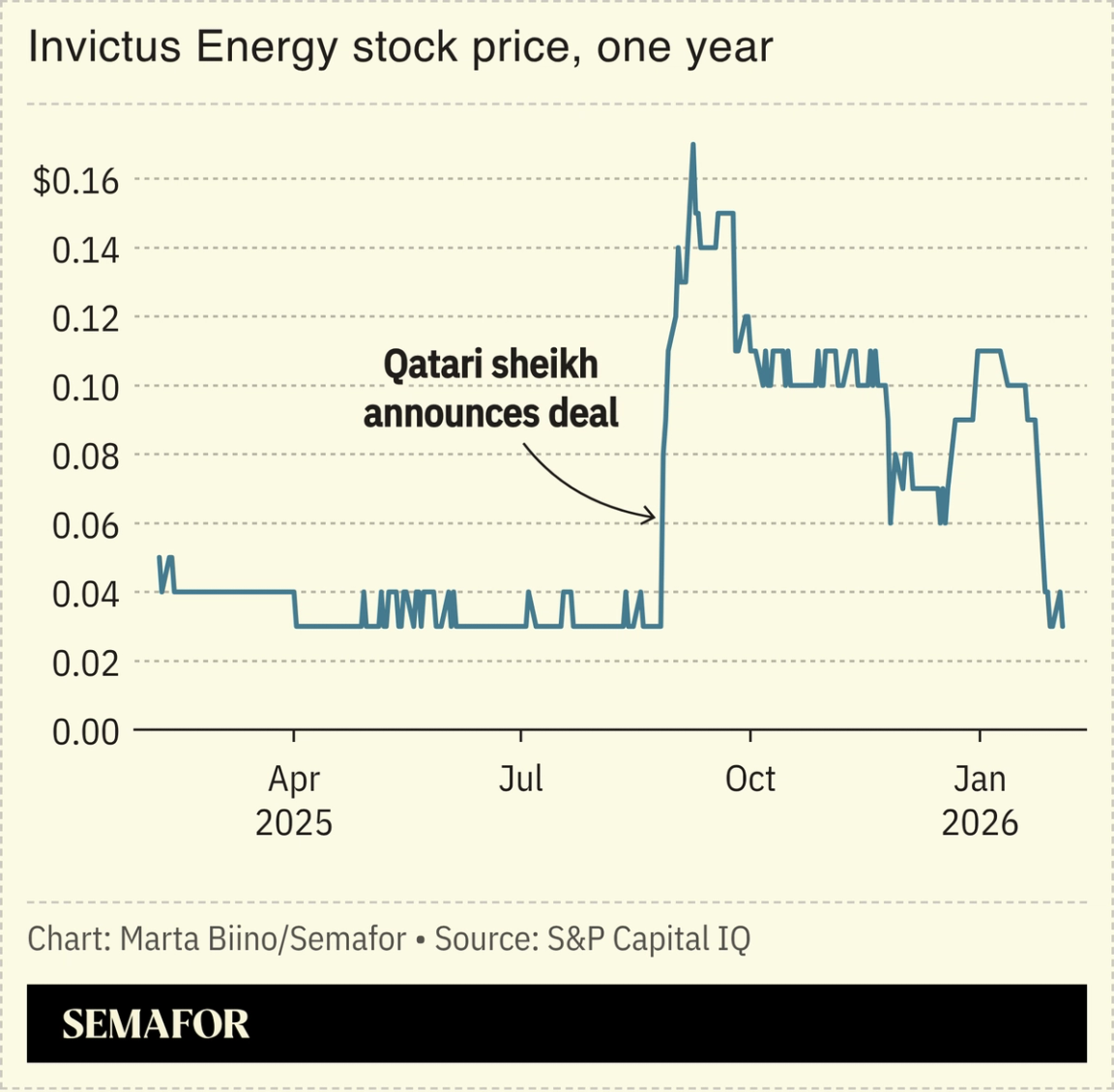

Failed Qatari deal torpedoes miner’s stock |

This chart is textbook penny stock: A headline sparks a surge, the deal fizzles, and then the shares go back to being worthless. What’s notable — to us — about Invictus Energy, a tiny Australian-listed oil and gas explorer with a single concession for a gas find in Zimbabwe, is the Gulf connection. In September, a Qatari sheikh went on a whirlwind tour of Africa, meeting presidents and pledging to invest a total of $102 billion in Botswana, Burundi, the Democratic Republic of Congo, Mozambique, Zambia, and Zimbabwe. The only tangible deal was a $24.5 million stake in Invictus. The $102 billion spree hasn’t materialized. And the much smaller investment won’t happen either. Invictus said the Qatari firm “does not intend to satisfy its contractual obligations” and has proposed provisions that don’t comply with regulations and include “unacceptable and non-commercial terms.” Invictus shares, which were up fivefold at one point, have now returned to A$0.05 ($0.03) — a level at which they traded for months before the sheikh’s deal. — Mohammed Sergie |

|

Hakbah digitizes traditional Saudi savings |

Courtesy of Hakbah via Apple Store Courtesy of Hakbah via Apple StoreSaudi fintech Hakbah is pushing to formalize one of the region’s oldest financial habits, the jameya savings circle, as the kingdom prepares a new National Savings Strategy. Founder Naif Almutairi told Semafor that the platform, which digitizes traditional group savings, now has more than 2 million registered users. Hakbah has operated since 2020 under a pilot project regulated by the central bank while awaiting dedicated rules for savings products expected this year. “We need regulation for savings, not just for jameya,” Almutairi said. Hakbah matches users with saving circles of different durations: Shorter ones spike before Ramadan and Eid, while others cover weddings or travel. Almutairi’s bet is that Saudi behavior differs from that of the West: “In the West, people save for retirement. Here, we save for living.” Around 70% of customers are between 23 and 37, saving for tuition or electronics, for example. “That’s saving to spend, but it builds the habit,” he said. — Manal Albarakati |

|

BlueFive adds to its cash pile |

The amount Abu Dhabi-based BlueFive Capital raised for a fund focused on tech investments in the US and Europe. The Onyx Fund will focus on tech and growth capital investments in AI, biotechnology, and advanced computing, and expects to start announcing deals in the next few months. The fund is anchored by sovereign investors in the Gulf. The latest cash haul adds to a $2 billion private equity vehicle that BlueFive — founded by former Investcorp co-Chief Executive Hazem Ben-Gacem in 2024 — closed about six months ago. BlueFive’s assets under management have now swelled to $7.4 billion. It’s aiming to invest across rapidly growing economies in Asia, the Middle East, and South America. Even amid a period of low oil prices, the Gulf has still been a prime destination for private equity fundraising, although state-controlled firms are increasingly looking to use their cash to sway asset managers into investing into the region. — Matthew Martin |

|

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Ben Powell, BlackRock Investment Institute’s APAC & Middle East investment strategist.  |

|

Courtesy of KML Courtesy of KMLSaudi luxury label KML brought an avant-garde take on traditional silhouettes to Paris Ready to Wear Fashion Week. Siblings Razan and Ahmed Hassan showcased a line that mixes sharp tailoring with Saudi heritage. (A skirt will run you more than $1,000). The models walked the runway barefoot, as a nod to how Muslims enter sacred spaces. The look is a luxury take on identity: Large leather belts recall those worn by Bedouin men, while skirt silhouettes reference traditional dress from the Eastern Province and the Hijaz. The brand’s rise, backed by a government program, comes as the kingdom builds a University of Arts and has allocated $80 million for a fashion fund to invest in designers. Riyadh Fashion Week, now an annual fixture, is also part of an effort to promote Saudi designers on the global stage. |

|

|