| | In this edition: South Africa faces exclusion from AGOA, a new infrastructure fund, and Africa’s dis͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- S. Africa faces AGOA snub

- New infrastructure fund

- Ampersand’s pivot

- Netflix deal fallout

- Tech funding grows

- DR Congo’s road loan

The growing threat to Africa’s hornbills. |

|

The White House’s newly published National Security Strategy, an attempt to lay out the Trump administration’s foreign policy priorities in 30 pages, devotes just over half a page to Africa. Both the brevity and the content offer few surprises. In line with US President Donald Trump’s America First approach, the strategy document stresses the need to adopt an “investment and growth paradigm” instead of one centered on foreign aid. It emphasizes the opportunity Africa presents for US companies to access critical minerals and energy supply deals, while also nodding to a potential role for engagement in ending conflicts. One Washington-based policy adviser on Africa issues called the strategy “myopic,” while another described the administration’s approach as showing an “aggressive disinterest” in Africa. But there was also a broader consensus that reshaping the previous US-Africa relationship was necessary. “It’s the most honest statement of US interest in Africa we have seen in a while,” said Cameron Hudson, a former White House official in the George W. Bush administration. “Like all strategies it is as much a response to the previous administration’s strategy as a statement of their own. They’re saying ‘we don’t care about everything under the sun.’” |

|

South Africa faces AGOA exclusion |

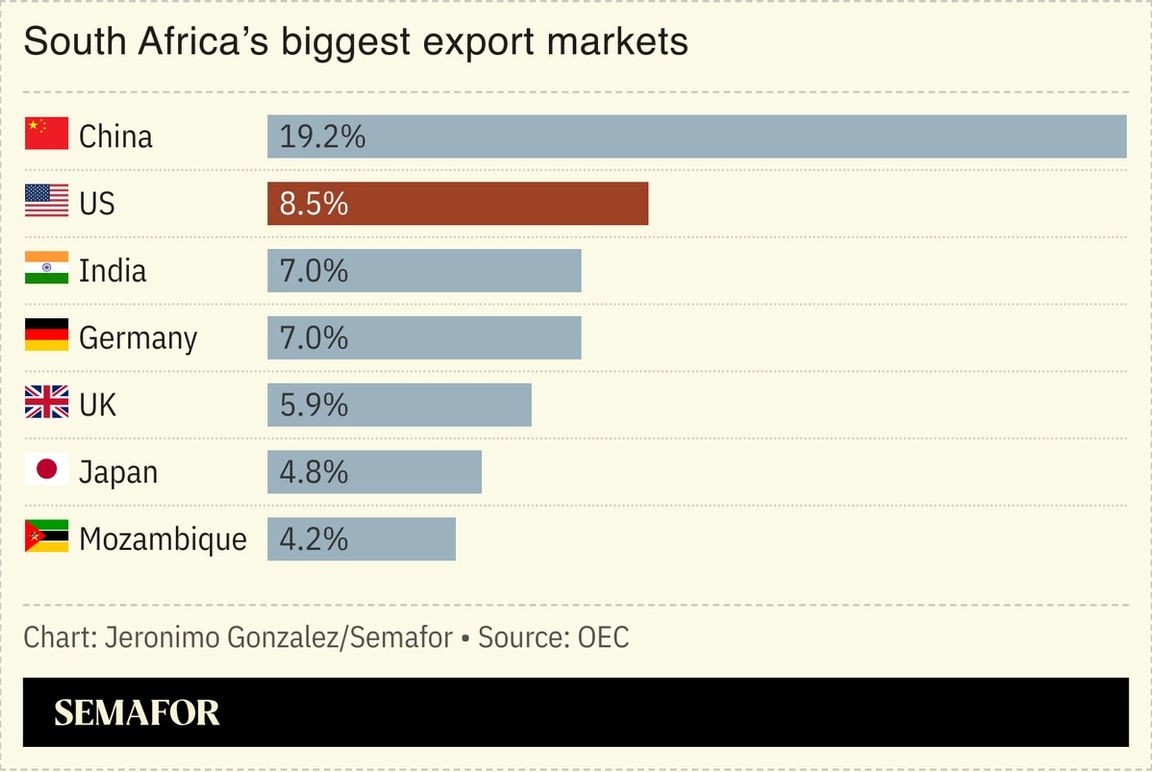

South Africa could be excluded from a renewed preferential trade pact between the US and sub-Saharan African countries, a US official said, in the latest uptick of tensions between Pretoria and Washington. US Trade Representative Jamieson Greer told a Senate hearing that President Donald Trump was considering extending the African Growth and Opportunity Act (AGOA) that expired in September, but may “give South Africa different treatment.” When asked if the country, Africa’s largest economy, should be left out of any future extension of AGOA, he said: “I’m open to that because I think they are a unique problem.” Ties between Washington and Pretoria have sharply deteriorated during Trump’s second term. In August, Washington imposed 30% tariffs on imports from South Africa as part of a global tariff overhaul, and heated talks for a new trade deal appear to have stalled. Last week the White House said it would not invite Pretoria to join the G20 summit it is hosting next year after boycotting the same event hosted by South Africa last month. |

|

$500M infrastructure fund launched |

Nichole Sobecki for The Washington Post via Getty Images Nichole Sobecki for The Washington Post via Getty ImagesAsset management firm Gemcorp Capital is working with Angola’s sovereign wealth fund to launch a $500-million Africa-focused infrastructure fund in Abu Dhabi. The aim is to make investments across Africa to inject private-sector cash into critical minerals, water, food security, and clean energy. Infrastructure development in these areas could provide a “transformative” boost to economic growth, Tom Hughes, Gemcorp’s marketing director, told Semafor. London-based Gemcorp, which focuses on emerging markets, said it will contribute up to $50 million to the fund and manage the projects. Angolan sovereign wealth fund Fundo Soberano de Angola said it will make an initial $50-million investment, which could increase to $200 million. The firms plan to secure the remaining capital from global investors. The Pan-African Infrastructure Fund will tap into growing investments the Gulf region has made into Africa in the last few years. The Gulf has developed an ecosystem of advisers and banks to facilitate investment into the continent, many of whom have gathered at this week’s annual Abu Dhabi Finance Week event, which seeks to position the emirate as a global hub for capital. — Alexis Akwagyiram |

|

Ampersand pivots to meet competition |

Courtesy of Ampersand Courtesy of AmpersandOne of Africa’s leading e-mobility startups is shifting strategy in response to mounting competition from Chinese manufacturers, its CEO told Semafor. Ampersand, a Rwanda and Kenya-based manufacturer of electric motorcycles and batteries, will make its network of roughly 70 charging and battery-swap stations open to drivers of motorcycles from competing manufacturers, the company said on Monday. It is the first startup in Africa’s increasingly crowded e-mobility scene to make that move. The reason, CEO Josh Whale said, was a recognition that the company’s motorcycle manufacturing line is struggling to compete against the economies of scale that China-based competitors, which are rushing into African markets, can achieve. “Going toe to toe with those guys wasn’t a long-term sustainable strategy,” he said. Ampersand has a more defensible edge, he said, when it comes to the design and production of batteries and related software, and the operation of swap stations. Chinese manufacturer Wylex will be the first whose bikes will be compatible with Ampersand batteries, Whale said; others will be added to the roster soon. — Tim McDonnell |

|

MultiChoice reels from Netflix proposal |

Mike Blake/Reuters Mike Blake/ReutersNetflix’s proposed $72 billion takeover of Warner Bros. Discovery’s studio and streaming assets has landed at a delicate moment for South Africa’s MultiChoice and its incoming owner, Canal+. MultiChoice, Africa’s largest pay TV player, is already at risk of losing up to 12 WBD channels including CNN and TNT Africa from its DStv platform from January if a new carriage agreement isn’t reached. If Netflix ends up owning the studios and streaming division behind that content, the economics of renewing those rights become even tougher, argued Duncan McLeod in South Africa’s TechCentral publication. He said a Netflix-controlled Warner Bros. increases the likelihood that premium titles migrate to streaming-first distribution — potentially reducing or eliminating what MultiChoice’s DStv and Showmax can license. Canal+, which has embarked on aggressive cost-cutting amid subscriber declines, may be unwilling or unable to pay steeply increased fees. One obvious reason for MultiChoice to hedge its bets is that Paramount, owner of US networks like CBS and MTV, has come in with a larger $108.4 billion offer to buy all of WBD’s assets, a move that would change this equation. |

|

African startup funding rebounds |

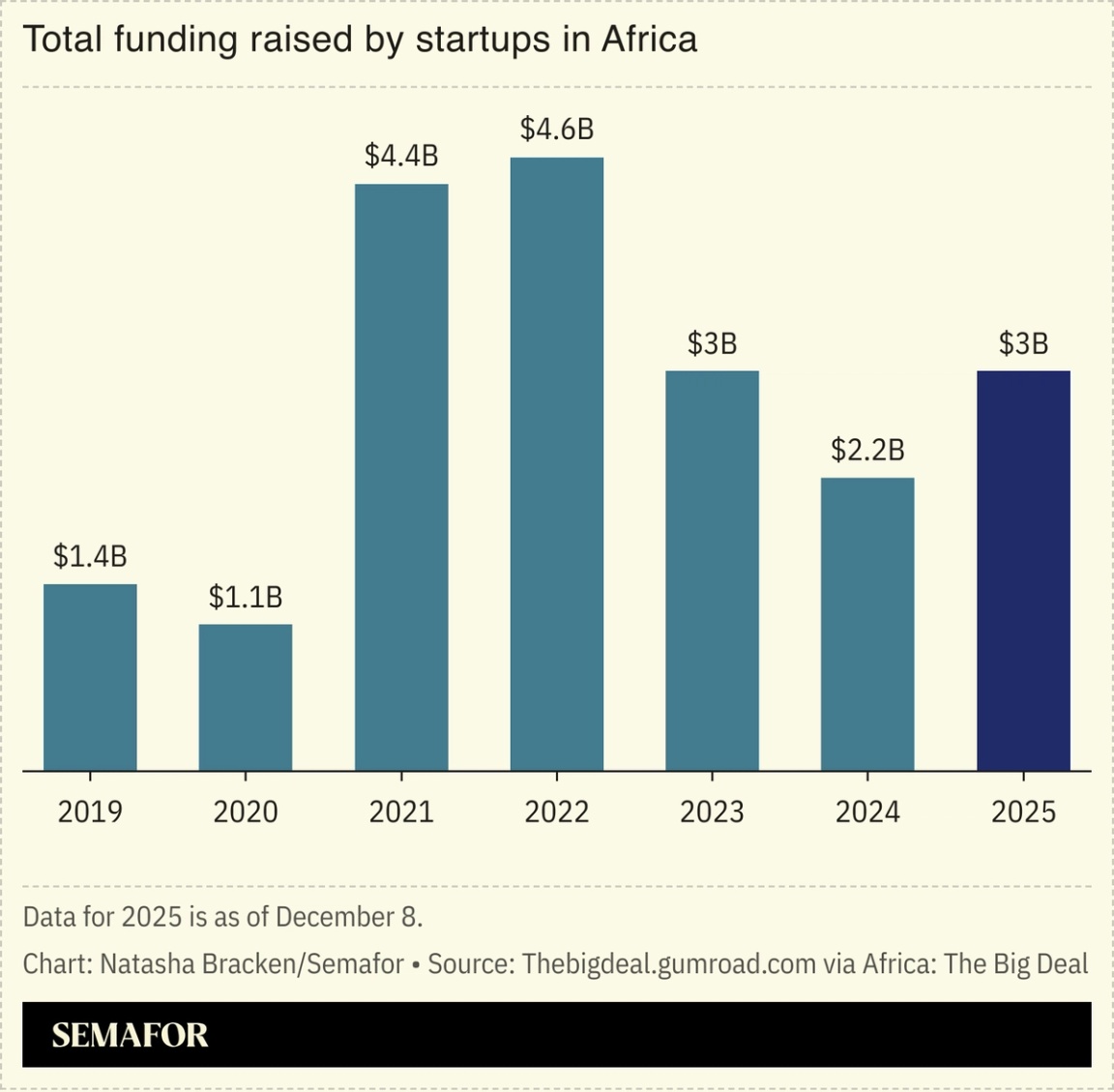

African startups crossed the $3 billion mark for fundraising in 2025, the highest total since 2023, signaling a rebound in investor activity. Investments into African startups totaled $2.2 billion last year, a 25% decrease from 2023 amid a slowdown in venture capital bets on the continent. But this year has produced a 33% increase in receipts, according to Africa: The Big Deal, a platform that tracks the data. Some of the biggest funding deals this year have come in the last two months, notably electric vehicle provider Spiro’s $100 million and the $90 million banked by Nigerian fintech Moniepoint. Relatively smaller amounts, like the $17 million raised by Ivorian fintech firm Djamo in April, have also figured in the continent’s fundraising rebound. The eventual total for 2025 will remain short of Africa’s 2022 peak, but positive double-digit growth can also be read as “a real breath of fresh air,” The Big Deal said. |

|

Hosted on the sidelines of the World Economic Forum, Africa Collective Davos 2026 unites global and African leaders to elevate Africa’s economic agenda through panels, roundtables, and networking that sparks collaboration between the private and public sectors. Join Africa Collective Davos, January 19–22 at the Africa Collective House at the Hard Rock Hotel in Davos — learn more and register interest here. |

|

DR Congo secures road upgrade loan |

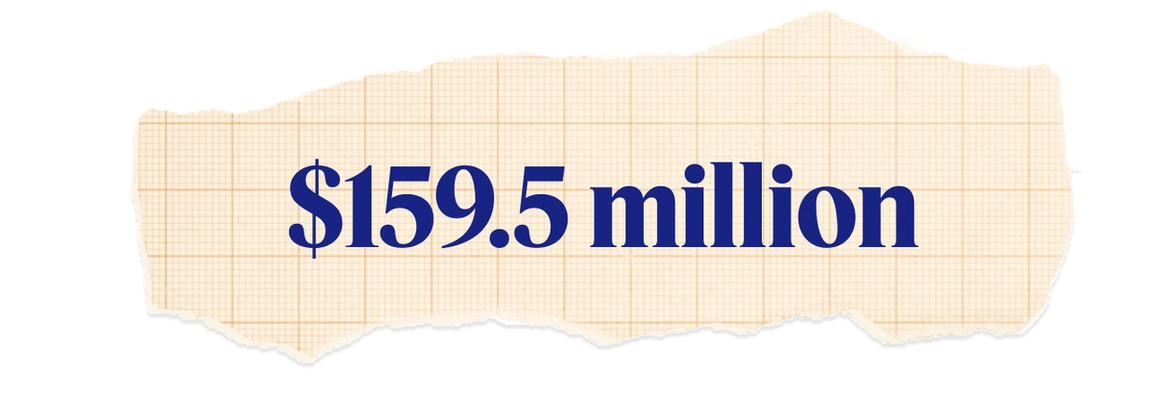

The size of an African Development Bank loan to DR Congo for road upgrade projects that will improve access to the Ngandajika Agro-Industrial Park. Located in a province of about a million residents some 900 miles from the capital Kinshasa, the park is a pilot project for agricultural development, one the AfDB described as “a major milestone for Central Africa’s economic integration and for advancing agricultural industrialization in the DRC.” While often noted for being rich in critical minerals, especially copper and cobalt, DR Congo relies on agriculture to employ over 60% of the population. Nearly a fifth of the country’s GDP comes from the sector. The Congolese government will provide co-financing to meet the road project’s total cost of $177 million, the bank said. |

|

Business & Macro |

|

|