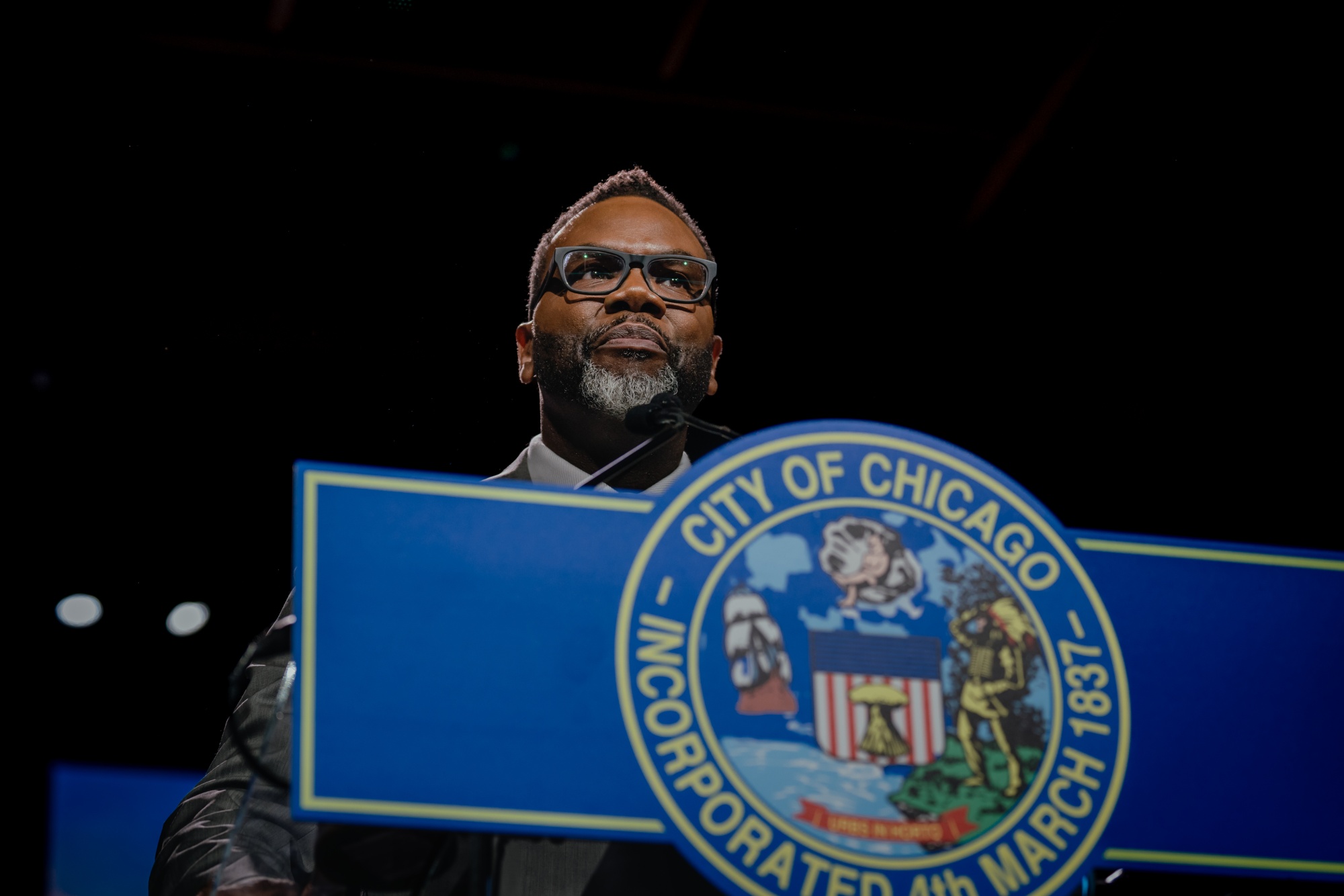

| Students in Chicago are soaking up the last few days of summer before classes start again on Monday. And the heat is on for education leaders, in the city and nationwide, writes Chicago-based municipal finance reporter Shruti Date Singh, as budget pressures are everywhere. Plus: Boxes are in a slump, Twitter’s pre-Elon Musk CEO has a new startup, and capital is flowing into the Middle East. If this email was forwarded to you, click here to sign up. As more than 325,000 Chicago Public Schools students head back to classrooms next week, the fourth-largest US school district is caught in a financial quagmire. It’s still trying to figure out how it will pay for its estimated $10.25 billion in expenses, even though the new fiscal year began July 1. Many of the district’s money challenges are unique to the city, but some are examples of the shortfalls school systems around the country are facing as the federal pandemic aid provided for the past few years ends. For CPS, the largest US municipal junk bond issuer since the turn of the century, the cash crunch has returned in a big way. It’s short about $734 million, with more deficits coming: They’re expected to reach $835 million in fiscal 2030. Their size will depend on the calls the new 21-member hybrid board—split between elected and mayor-appointed members—makes in the next two weeks. By law, the board must vote on a budget within two months of the start of the new fiscal year. That puts the deadline at the end of this month. So a vote is scheduled on Aug. 28. “The choices we have at hand are difficult ones,” said Michael Sitkowski, chief budget officer for the district, when he presented the proposed budget to the board on Wednesday. The plan includes a mix of cuts away from the classroom, a hiring freeze at the central office and bigger savings from debt refinancing. The district budget office is advising against borrowing for operations to avoid credit rating cuts. The proposal also includes the option to make a controversial $175 million payment to the city for a severely underfunded municipal pension only if the state and city governments send more revenue. That’s going to be tough.  Mayor Brandon Johnson. Photographer: Jamie Kelter Davis/Bloomberg Chicago Mayor Brandon Johnson, a former union organizer who worked as a social studies teacher, needs to close a city deficit projected at more than $1 billion for next year. He’s been counting on the school district to pay the $175 million to the city. Last school year, disagreements stemming from this payment contributed to the ouster of the previous school CEO after Johnson fully replaced the seven-member mayor-appointed board in the months before the partially elected one took office. Johnson and the Chicago Teachers Union, which backed him during his campaign for mayor in early 2023, are pointing the finger at the state for underfunding the district. More revenue from Washington is highly unlikely amid education and immigration policy changes. The district noted in its fiscal 2026 budget book that “the federal government has recently attempted to withhold additional funding from CPS.” Nationally, the Trump administration unsuccessfully tried to stop more than $6 billion in grants that are used in programs for migrant children and English-language learners and for after-school care. “The annual CPS budget crisis is the direct result of decades of underfunding,” Vicki Kurzydlo, the recording secretary for the Chicago Teachers Union, told board members Wednesday. All this means the Chicago school district might have fewer janitors, crossing guards, lunchroom attendants and assistants for students with special needs. Members of the Service Employees International Union, which represents janitors, protested the proposed cuts on Wednesday morning, holding up brooms and mops outside the district’s office. Some parents, unions representing the support staff and community activists are decrying the prospect of dirtier schools, less help for students who need the most attention and more borrowing. Kids First Chicago, a 10-year-old advocacy group, is urging the district to neither send the city the pension payment nor seek short-term borrowing. It’s pushing to “keep every possible dollar focused on CPS students and classrooms.” “We are also deeply concerned about proposals to borrow before there is clarity from Springfield, Washington or City Hall about what resources may—or may not—still be available,” the group said in an open letter to the board. “Using debt now to cover a City obligation would leave CPS with fewer options if revenues decline later this year. Even worse, it would deepen CPS’s structural deficit and force harsher cuts in future budgets.” |