| | With fewer attendees and many businesses exiled, the summit risks losing accountability.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Net Zero |  |

| |

|

- COP30’s pressure problem

- Oil outlooks clash

- Hydrogen hopes

- PPA ‘frenzy’

- Trump’s SMR push

Europe helps Ukraine’s gas market, but blocks ‘cat bond’ investors. |

|

| |  | Tim McDonnell |

| |

Wagner Santana/Reuters Wagner Santana/ReutersThe COP30 climate summit planned for November in Brazil could be the smallest COP in years, with logistical headaches and the Trump administration’s withdrawal threatening to undermine the event’s credibility as a forum for meaningful climate diplomacy. In a public letter on Tuesday, COP30 president André Aranha Correa do Lago, the top climate and energy official in Brazil’s Ministry of Foreign Affairs, sought to tamp down fears that soaring hotel prices and limited flight options in Belém, the midsized Amazonian city hosting the event, will keep attendees away. And summit organizers said this week that they have no plans to relocate the event. The question is who will be there to listen: Numerous national delegations, NGOs, and business groups have said they either won’t attend or will send a skeleton staff, which one Brazilian environmental group said could make COP30 “the least inclusive in history.” At COP summits there’s always a tradeoff between practicality and accountability. Still, at COP30, the choice of location risks undermining the event’s mandate. Every hour delegates spend negotiating the details of their access is time wasted making progress on substantive issues, and the absence of businesses, sub-national government leaders, and other adjacent participants will take pressure off the negotiators. |

|

Ahmed Jadallah/File Photo/Reuters Ahmed Jadallah/File Photo/ReutersOPEC and the International Energy Agency diverged — as usual — with their latest projections of the oil market, released separately this week. The two organizations have increasingly presented diverging worldviews of the energy transition, with the oil producers’ group insisting crude demand is buoyant and likely to remain so, while the IEA insists it is soon to fall. And so it was with their latest reports. OPEC on Tuesday predicted a tighter oil market, driven by stronger demand and slower supply growth among countries outside the alliance. It lifted its 2026 demand forecast, and cut its projection for supply from non-members next year. The combination — if it plays out — could support OPEC’s push to claw back market share after years of output cuts left room for US shale and other producers to expand. Meanwhile, in the IEA’s view, supply is far outpacing demand: It lowered its demand growth forecasts for both 2025 and 2026, and projected faster supply growth, driven by OPEC production increases that began in April. — Natasha Bracken |

|

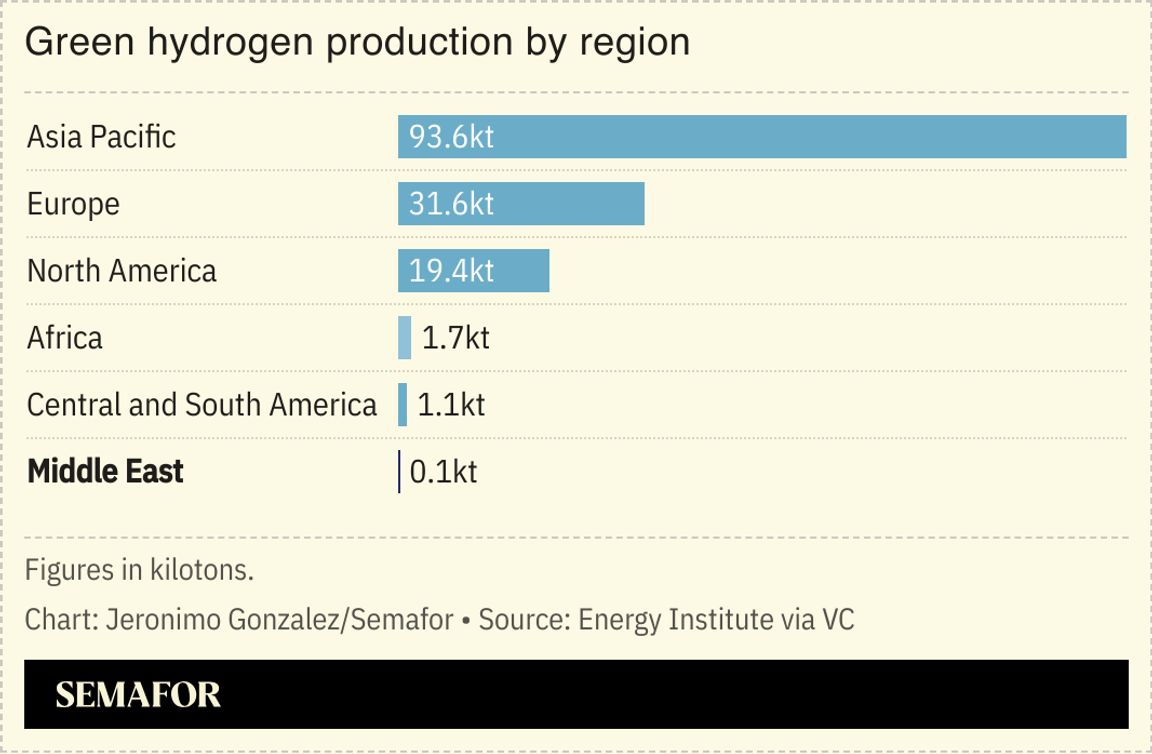

Oman is pushing ahead on its plans to become a world-leading producer of low-carbon hydrogen fuel. An Omani company picked a Chinese partner to build a factory in Duqm that will make equipment for Oman’s green hydrogen industry. The joint venture between United Engineering Services and China’s Sungrow Hydrogen will produce electrolyzers, liquefaction systems, and other industrial components needed for hydrogen production. The project adds momentum to a $35 billion effort to transform Duqm — a port and industrial city in southern Oman — into a global hydrogen hub. Foreign firms such as France’s Engie and South Korea’s Posco are involved in the buildout, which aims to produce 1 million tons of green hydrogen annually by 2030. Oman seeks to become the world’s sixth-largest hydrogen exporter by 2030, with projections for hydrogen sales to surpass LNG by 2050. Producing green hydrogen at a price that can compete with natural gas or fossil fuel-based hydrogen is still not possible, but other countries in the Gulf, sub-Saharan Africa, and Europe are leaning into the challenge in anticipation of capturing a highly lucrative future market. But in the US, the industry is losing steam after Congress axed a key tax credit: Companies that had major hydrogen projects underway in the US, including Thyssenkrupp Nucera and Fortescue, have announced in recent weeks that the projects are no longer viable. |

|

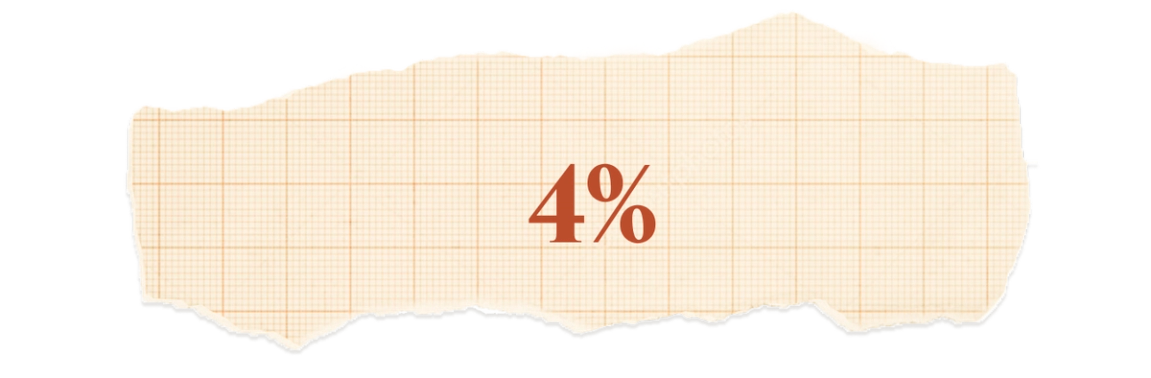

The increase in average price for renewable power purchase agreements since the One Big Beautiful Bill Act was signed last month. According to a survey of clean energy project developers by LevelTen Energy, a platform for buying and selling power from commercial-scale renewable energy projects, the tax credit cuts enacted by the bill are already driving a “frenzy” for new deals, in anticipation of much higher power prices next year. |

|

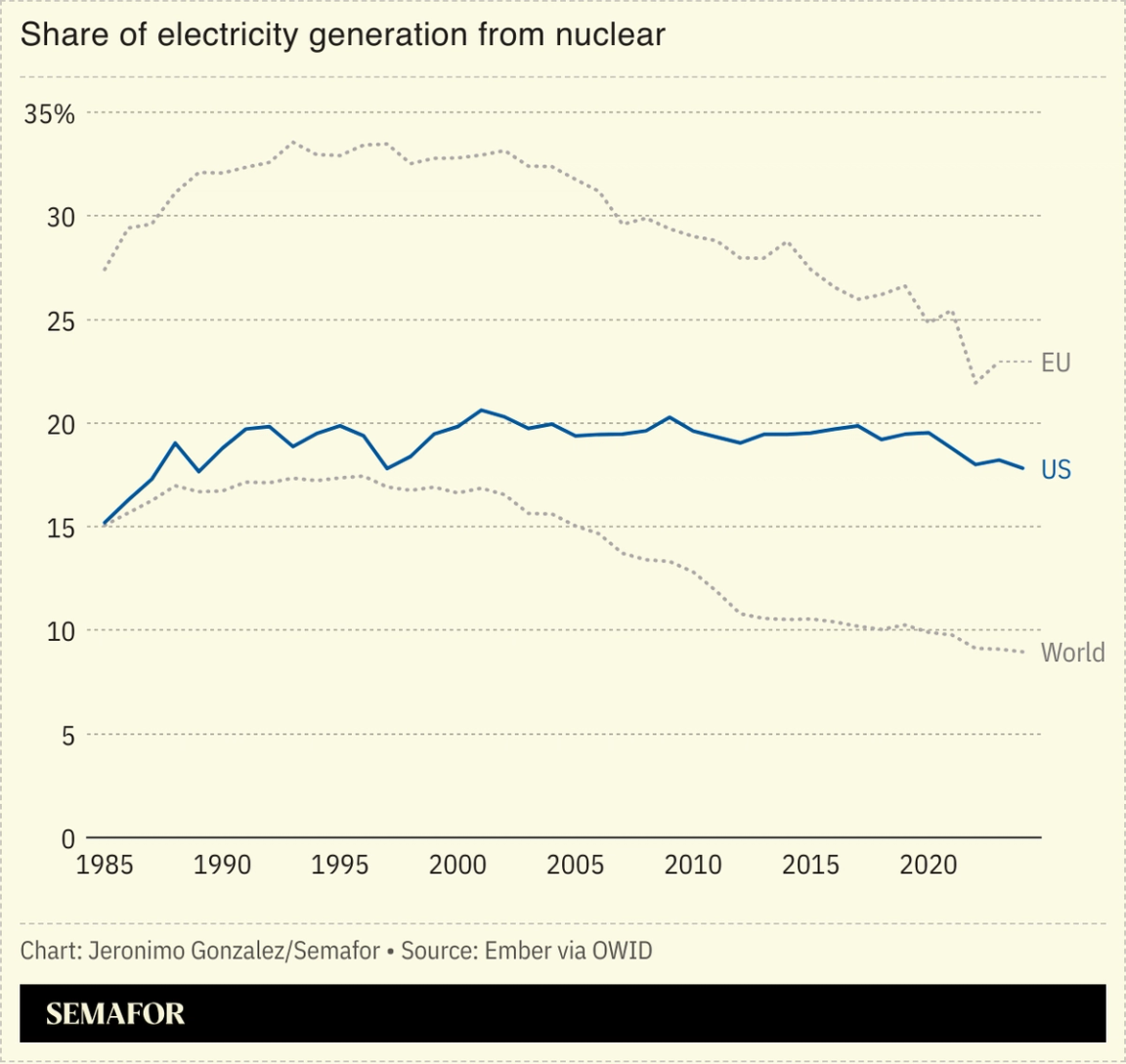

The US Department of Energy on Tuesday kickstarted a pilot program to deploy small nuclear reactors across the country. Eleven projects were selected, with the aim of getting three to be operational in less than a year, Reuters reported, and wider commercial deployment expected by 2030. Microreactors can fit in a truck trailer and generate about a thousandth of the energy of a major legacy nuclear plant. Nuclear power is having a moment in the US, embraced by pop culture and politics, The Wall Street Journal wrote, and fueled by Big Tech’s demand to power energy-guzzling data centers. The White House wants to speed up approval for microreactors, but some scientists warned of unresolved safety and waste disposal issues. |

|

New Energy China Daily via Reuters China Daily via ReutersFossil FuelsFinanceTechPolitics & Policy |

|

|