Points of Return

| To get John Authers’ newsletter delivered directly to your inbox, sign up here. Bessent says “any model” suggests the fed funds rate should | | | | | | To get John Authers’ newsletter delivered directly to your inbox, sign up here. | | | | - Bessent says “any model” suggests the fed funds rate should be 1.5% to 1.75% lower.

- This isn’t the case, but markets like what they hear: bond yields down, stocks up.

- Gold miners are having a great rally.

- The invasion of Ukraine seems to have tipped haven investors toward gold.

- AND: A Seventies Britcom star gets recognized by the Kennedy Center.

| | Looking at All the Models | | | Scott Bessent, the US Treasury secretary, made big news on Blooomberg Surveillance. He told the televised audience that “if you look at any model” for the fed funds rate, it suggests that “we should probably be 150, 175 basis points lower.”

This is breathtaking. With the current effective fed funds rate at 4.33%, he is suggesting that it should be about 2.6%. Over the last 70 years, the rate has never been that low with inflation as high as it currently (with the core reading above 3%). So apparently “any” model now shows that US monetary policy has been misguided throughout that entire period and needs to be changed: In fact, it's easy to find a model that says fed funds should be far higher than 4.33%. Arguably the most famous is the Taylor Rule, named for John Taylor, a Stanford economist and former senior Treasury official who was a candidate for the Federal Reserve chairmanship eight years ago. His formula suggests the next move should be up:

This is available on the Bloomberg terminal; it’s not exactly obscure. We also handily provide various different versions of the Taylor framework. This is the fed funds rate under the adaptation made by Gregory Mankiw, the Harvard economist who served as George W. Bush’s chairman of the Council of Economic Advisers:

The point is not that these models are necessarily right. They may well not be. And Bessent has a right to express his opinion. But it’s absurd to suggest that “any” model would call for fed funds to be so much lower, and alarming to hear it from the US Treasury secretary. The bottom line we already knew from presidential social media accounts: Donald Trump wants lower interest rates, and more control over them. Fed independence has long been contested, and other presidents have kicked against it — but since the end of the gold standard in 1971, an independent Fed has been central to maintaining the dollar as the linchpin of the global economy. This is a dangerous game. Further, the drawback of allowing the Treasury Department to control both fiscal and monetary policy is that it can then coordinate them to rhyme with the political cycle. In the UK, finance ministers set base rates until 1997, creating a pronounced “stop-go” effect as governments pumped up the economy ahead of an election, and put on the brakes once they’d been reelected. This is miserable economics, as the UK’s weak postwar growth demonstrates, but decent politics. Even so, that implies that it’s madness for a government to behave like this six months into a four-year term. The likely outcome would be a short-term boom, and a pretty serious bust in time for the next election in 2028. So why all the pressure? The most obvious answer is to bring down longer Treasury yields, which determine the cost of servicing the government’s debt. All else equal, lower overnight rates from the Fed mean lower longer-term yields. But the Fed doesn’t control the long end. Last September’s jumbo fed funds cut was greeted by a rise in the 10-year yield. There have been many other incidents when Treasuries refused to follow the lead that the Fed set for them: The White House has also been clear that it wants a weaker dollar. The latest dose of pressure on the Fed appears to have achieved this, as the currency has fallen over the last few days. That’s helpful for many people, but particularly for the emerging markets, where stocks have at last taken out the high they made during excitement over China in early 2021: For now, the impact is clear as investors are persuaded that there is no recourse but to continue buying US stocks. The latest Markets Pulse survey of Bloomberg terminal users found 59% believing that pressure to lower interest rates would boost US stocks compared to peers — even though some 70% expect tariffs to have had a negative effect by the end of the Trump 2.0 term. The great majority were uncomfortable with the premium that US shares currently command — but leaning on the Fed has convinced many that the rate environment will get more conducive from here. | | | | | Bullion, the quintessential haven asset, has been range-bound since Liberation Day. Policy uncertainty remains high, but it has at least escaped the Trump 2.0 tariff crosshairs. Washington has clarified that gold will not be subject to levies after US Customs officials briefly threatened to impose a full 39% on imports of the metal from Switzerland. The gold price has nearly doubled in three years, and the incessant attacks on the Fed’s credibility have only strengthened its appeal. As TD Securities’ Daniel Ghali argues, the rally is ultimately a function of trust in the Fed, or lack of it. The past few months emphasized bullion’s credentials as a store of value even as its distant cousin, Bitcoin, enjoyed a good run. Since Inauguration Day, gold has performed slightly the better of the two: This has brought wind to miners’ sales as they now handily outperform the gold price. And, highly unusually, both havens are easily outperforming the S&P 500 at a time when it’s on a big bull run. This is how the miners compare to gold and the S&P over the past year: UBS’ Daniel Major attributes this to record free cash flows, limited increases in capex, and rising cash returns combining to restore investors’ confidence. With their balance sheets in great shape, he expects that miners can buy back more stock if the gold price stays firm: We expect organic growth projects to be accelerated as long-term price assumptions are increased faster than cost/capex assumptions improving internal rate of returns and we see potential for M&A to heat up. Albeit the message appears to be disciplined organic growth and a bias to regional consolidation and portfolio tidy-up over major M&A.

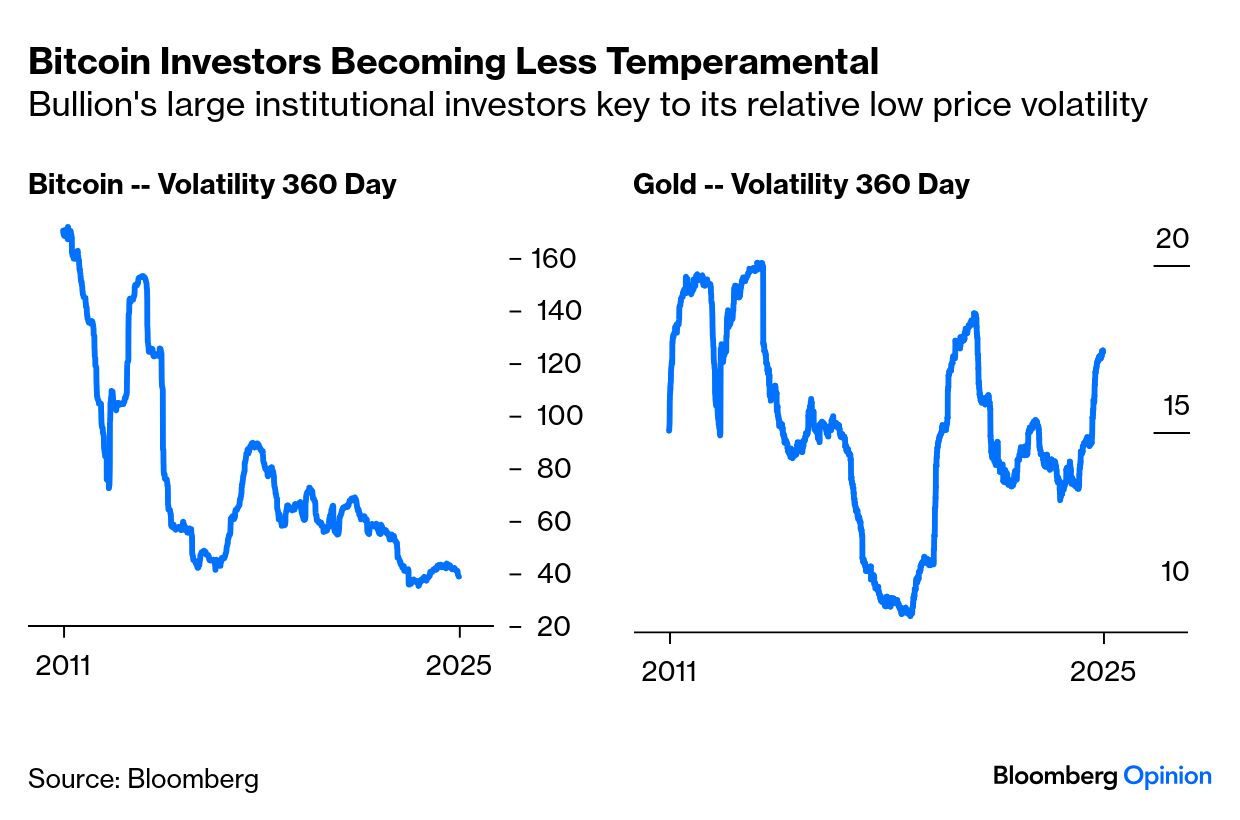

The miners are still trading below 2019 valuations. As the up-cycle for gold and gold equities matures, Major notes that shifting preference from “relatively expensive outperformers” to “cheaper turnaround stories” makes more sense: Bitcoin hit yet another all-time high in Wednesday trading, buoyed by a raft of crypto-friendly regulations that are likely to spur more institutions to get involved. It’s hard to gauge how much institutional adoption helps, but Charlie Morris of ByteTree Group in London suggests that this could show up in declining price volatility. Bitcoin remains notably more erratic than gold, as shown in this chart, but the way it has continued to offer a steady ride through a series of shocks in recent years is hard to ignore:  Volatility for Bitcoin and gold over the past 360 days was about 38% and 17%, respectively. Bitcoin’s has fallen again over the past month, while gold’s has picked up, presumably because of the furor around the Fed. Bitcoin might well gain additional momentum from an upcoming regulatory shift in the UK. The new regime, which takes effect from Oct. 8, allows retail investors to buy crypto-backed notes trading on approved exchanges like the London Stock Exchange. There are no guarantees, but cryptocurrency’s rebound following past regulatory easing suggests it might respond similarly this time. —Richard Abbey | | | | | There’s another golden point worth making as the world prepares for Vladimir Putin and Donald Trump’s meeting in Alaska. The prospect of peace in Ukraine has created minimal impact on global markets, largely because the war has been dismissed as a stalemate since late in 2022. But Putin’s disastrous invasion may have had the lasting effect of boosting gold’s status. Chris Watling of Longview Economics argues: By launching the Ukrainian war, Russia changed the global geopolitical equilibrium and created a bipolar (or even multipolar) world. As a result of that (and subsequent sanctions), trust in the international financial system broke down with certain parties (i.e. BRIC countries, and so on) looking for alternative “reserve assets” (stores of value). Often that has been gold.

For circumstantial evidence that this has happened, look at the ratio of the gold price to US Treasuries, proxied in this chart by the TLT exchange-traded fund which holds US government bonds of 20 years or longer: These are the two clearest and most proven shelters available to the world’s investors. It certainly looks as though gold’s advantages suddenly became much greater once the world had witnessed a return to war on the ground in Europe. For another way to look at this, the gold price is usually sensitive to the real yield on bonds. The metal pays no yield. Thus the lower the real yield on bonds, the higher the gold price can go, and vice versa. This was a remarkably strong relationship for many years. Then in early 2022 after Russia invaded), the two measures seemed to have nothing in common: (If you’re reading this on the terminal, try opening these charts in GP and then inverting one of the scales.) With the stock market apparently braced for monetary debasement and happy about it, while bond vigilantes look rather more nervous in Europe, the next few weeks should offer a fascinating test of just how much gold and bonds have changed their relationship. | | | | | Amid the hullaballoo over Trump’s tightening control over Washington institutions (from the police force to the Smithsonian), he has produced some interesting honorees for the Kennedy Center. His new slate includes Kiss, (which is magnanimous as bassist Gene Simmons hasn’t always a been a fan), arch-survivor Gloria Gaynor, and most notably Michael Crawford — beloved by the president as the original Phantom of the Opera, but best remembered back home as Frank Spencer, the most irritating but brilliant character 1970s sitcoms had to offer. They all deserve their baubles. More From Bloomberg Opinion - Chris Bryant: Globalization Can Survive the US Trade War

- Juan Pablo Spinetto: The US-China Fight Over Panama’s Canal Has an Unexpected Winner

- Bill Dudley: Warsh Has a Fairy Tale View of Fed Rate Policy

| | | | | You received this message because you are subscribed to Bloomberg's Points of Return newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | | |