| | US inflation holds steady, Russia advances in eastern Ukraine, and Perplexity makes a surprise bid f͏ ͏ ͏ ͏ ͏ ͏ |

| |   Donetsk Donetsk |   Guangzhou Guangzhou |   Wellington Wellington |

| Flagship |  |

| |

|

The World Today |  - Russian breach in Ukraine

- US inflation steady

- Questions on US chips deal

- Evergrande delists in HK

- Deterring China over Taiwan

- China’s global gold ‘mafias’

- Perplexity makes Chrome bid

- New Zealand ends fuel tax

- No fatal accidents in Helsinki

- Air conditioning culture wars

An exhibition spotlights a surrealist painter who didn’t have time to be anyone’s muse. |

|

Russian breach ahead of US talks |

Sofiia Gatilova/Reuters Sofiia Gatilova/ReutersRussian troops made a sudden breach in eastern Ukraine, in what analysts say is an attempt to pressure Kyiv into giving up land, days before crucial talks between Washington and Moscow. Ukrainian President Volodymyr Zelenskyy said Tuesday that Kyiv wouldn’t give up the eastern Donbas region, amid concerns about how much US President Donald Trump might concede to Russian President Vladimir Putin’s maximalist demands when the two meet in Alaska on Friday. Experts believe that Trump, who is determined to end the war, might be “walking into a trap that the Russian leader is setting on American soil,” The Atlantic wrote. The summit could play right into the hands of Putin, who is a “master manipulator,” The New York Times argued. |

|

US inflation data backs Fed rate cut |

|

Questions over Trump chip agreement |

The US government’s deal greenlighting two American chipmakers’ exports to China in exchange for a 15% cut of the revenue is drawing backlash. A prominent Republican lawmaker heading a China committee said the deal incentivizes Washington to let companies sell Beijing technology that enhances its artificial intelligence capabilities, and a Bloomberg columnist argued it gives China “a leg up the US might come to seriously regret.” The decision underscores worries that US President Donald Trump might be “willing to give too much” to secure a trade deal with China, The New York Times wrote. More broadly, Trump’s deal marks “a real significant break with the way the US government and businesses interact with each other,” an analyst said. |

|

Evergrande delisting marks end of an era |

CFOTO/Future Publishing via Getty Images CFOTO/Future Publishing via Getty ImagesChina Evergrande Group, the world’s most indebted real estate firm, said Tuesday it will be delisted from Hong Kong’s stock exchange, a landmark moment in China’s yearslong property crisis. Evergrande also said liquidators have recovered only $255 million of assets in 18 months, including a Claude Monet painting. The company was a poster child of China’s property boom in the 2010s, but its collapse beginning in 2021 came to embody the sector’s woes that fueled wider economic strain. “The golden era of real estate is gone,” a Deloitte analyst said. Days before the Evergrande announcement, developer China South City Holdings was ordered to liquidate, showing how the housing crisis has persisted despite state efforts to prop up the industry. |

|

Australia’s Rudd on deterring China |

Daniel Ceng/Anadolu via Getty Images Daniel Ceng/Anadolu via Getty ImagesStrong deterrence is key to preventing China from invading Taiwan, Australia’s ambassador to the US argued in a series of lectures at US military academies over the last year. Kevin Rudd — also Australia’s former prime minister and a decades-long China scholar — spoke in a personal capacity to at least five academies, pushing for Washington and its allies to convince China that action against Taiwan would be extremely costly, in both military and non-military arenas. Rudd argued the US must consider how Western and Chinese concepts of deterrence are misaligned. Beijing, for example, sometimes pursues dissuasion through so-called controlled escalation — potentially leading to “deeply destabilizing” aggravations. |

|

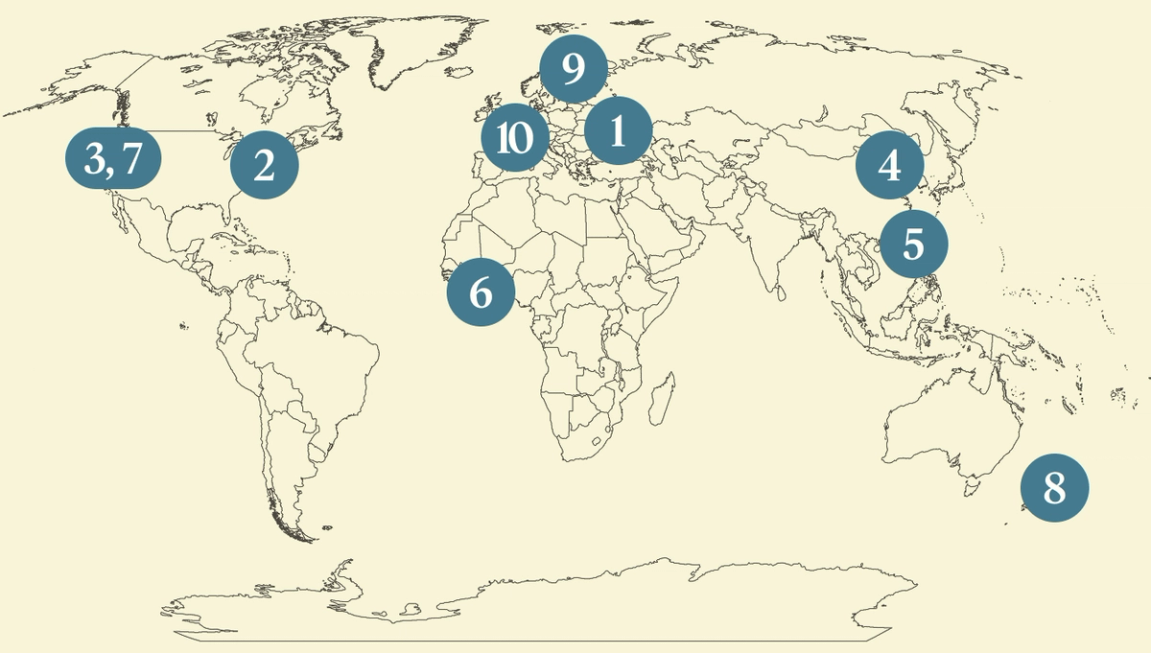

China’s global ‘mining mafia’ |

Universal Images Group via Getty Images Universal Images Group via Getty ImagesChinese syndicates operate a global “mining mafia” to extract gold with little regard for local rules and environmental regulations, a Washington Post investigation found. In the last 20 months, authorities in at least 15 gold-rich nations, from Ghana to the Philippines, have accused Chinese nationals or companies of illicit gold mining. Beijing has rebuffed calls to crack down on the operations. The scale of the procurement reflects China’s desire to reduce reliance on the US dollar and to influence international monetary systems, The Post wrote. “If you have a strategic interest in gold, you don’t want to just rely on the industrial gold-mining sector,” one expert said. “You’re trying to mop up gold wherever it is.” |

|

Perplexity makes bid for Chrome |

CEO Aravind Srinivas. Kimberly White/Getty Images for TechCrunch CEO Aravind Srinivas. Kimberly White/Getty Images for TechCrunchArtificial intelligence search startup Perplexity on Tuesday offered to buy Google’s Chrome browser for $34.5 billion in a surprise bid. The unsolicited offer is seen as a longshot, but reflects both the audacity of young AI enterprises and the pressures facing Big Tech: An antitrust ruling, due as soon as this week, could force Google to sell Chrome to dilute its monopoly on the internet search market. Perplexity CEO Aravind Srinivas recently told Semafor that he has studied Google “pretty deeply,” and suggested that instead of being acquired, Perplexity wants to take on larger competitors: “There's only two possibilities here, right? You come out winning or you die.” |

|

AI is already reshaping the energy sector. The grid is its next frontier. New technology is enabling utilities to transform customer experiences, unlocking new ways to optimize the grid, and elevating service quality and resilience. But bringing these innovations to scale will present real challenges. On the sidelines of Climate Week NYC, Semafor’s Tim McDonnell will sit down with Duke Energy Senior Vice President and Chief Administrative Officer Bonnie Titone to explore the opportunities and challenges of deploying AI solutions in the energy sector.

|

|

New Zealand to end fuel tax |

Meng Tao/Xinhua via Getty Images Meng Tao/Xinhua via Getty ImagesNew Zealand will replace its gasoline tax with road user charges. Most countries have traditionally used fuel taxes to fund highway maintenance and infrastructure. But that relationship is fraying: Cars are becoming more fuel-efficient and electric cars are becoming more common, meaning that fuel tax revenues are dropping but road expenditures are not. In New Zealand, fuel taxes account for more than 25% of the gasoline price, and have been collected since 1927. The transport minister said that the eventual plan is to use technology to monitor all cars’ road use and charge all owners for the distance traveled: Paying for road user charges “should be like paying a power bill online, or a Netflix subscription.” |

|

Helsinki sees zero traffic deaths |

Alessandro Rampazzo/AFP via Getty Images Alessandro Rampazzo/AFP via Getty ImagesHelsinki has not had a fatal traffic accident in more than a year. The Finnish capital has 690,000 inhabitants, similar to the US city of Nashville, Tennessee that saw 116 road deaths in 2024. Helsinki never reached that level but in the 1980s had around 30 fatalities a year. The key factor in curbing traffic deaths was the widespread imposition of 30km/h (18.6mph) speed limits, Finnish broadcaster Yle reported, although the expansion of pedestrian zones, cycle routes, and public transport also reduced car usage. Several other European cities have significantly reduced speed limits: London, where 20mph limits are commonplace, saw just 95 traffic fatalities last year, down from 400 a year in the 1980s, despite significant population growth. |

|

|