| | A wave of bankruptcies is coming for US solar installers this year if Congress proceeds with a plann͏ ͏ ͏ ͏ ͏ ͏ |

| |   London London |   Dar es Salaam Dar es Salaam |   San Francisco San Francisco |

| Net Zero |  |

| |

|

- Solar’s dim prospects

- US forces COP30 ‘rethink’

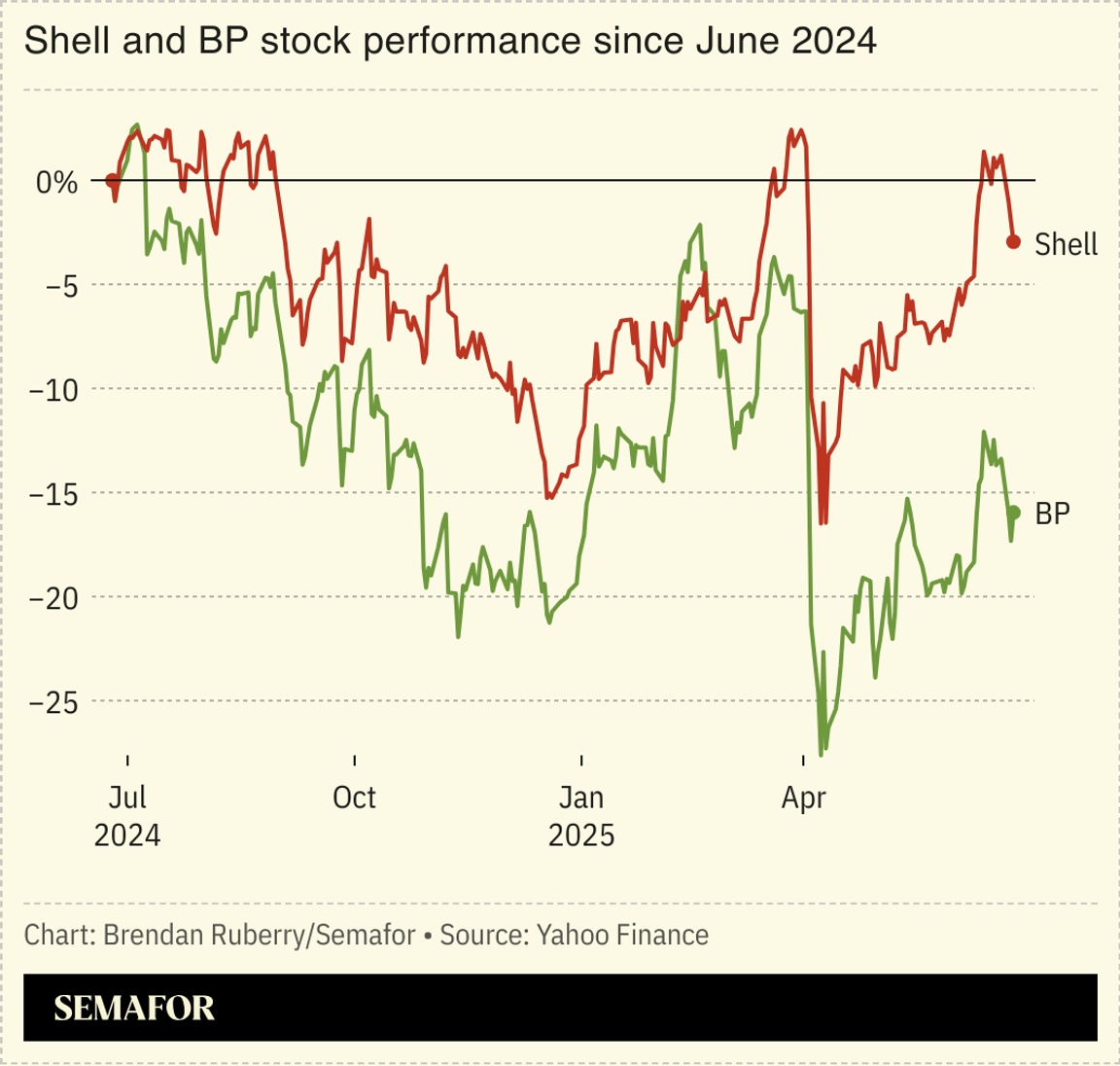

- No Shell-BP deal, yet

- Ethiopia’s EV growth

- Bright future for offsets

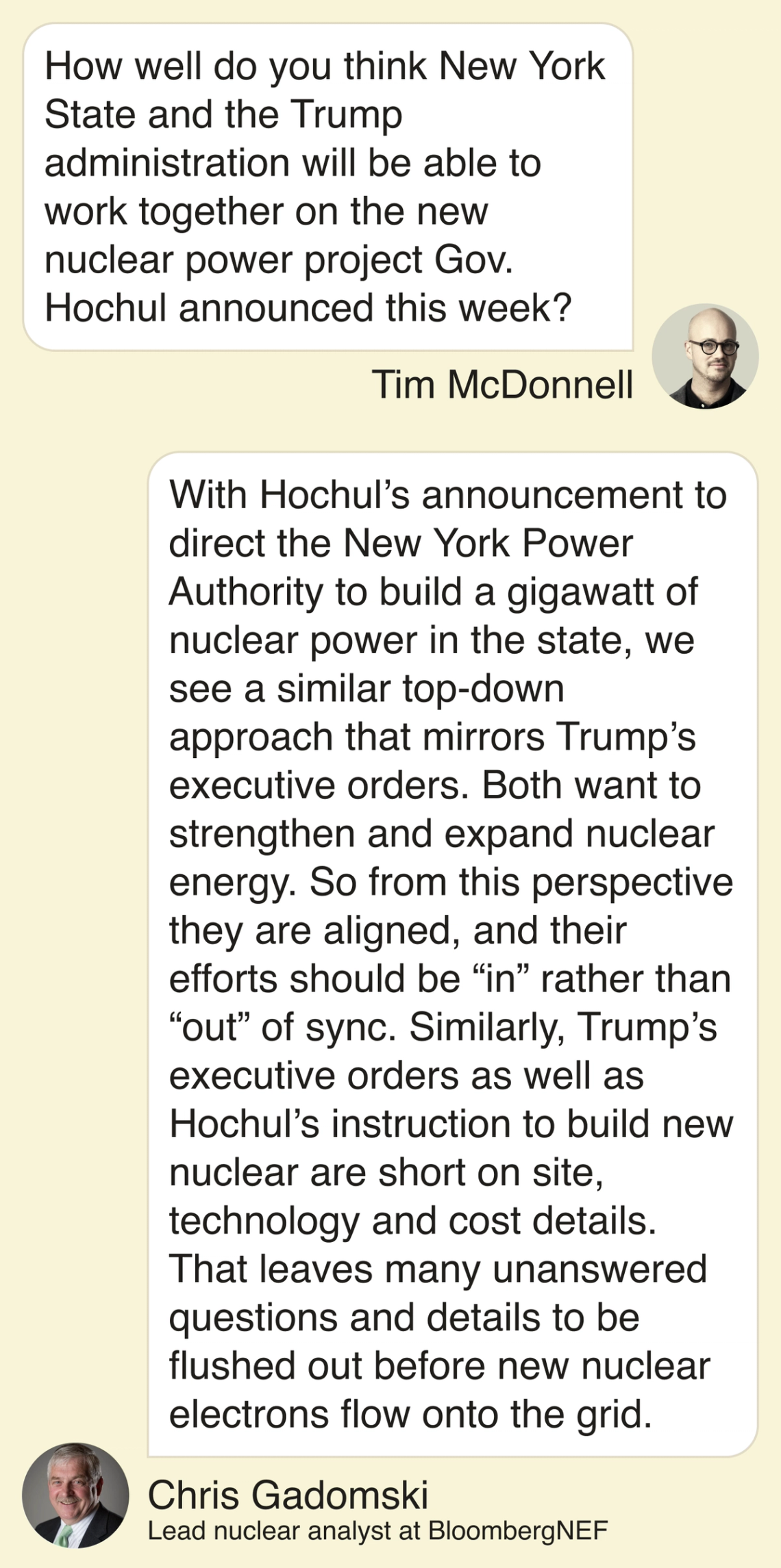

What Trump and New York Gov. Kathy Hochul have in common on nuclear power. |

|

US rooftop solar braces for decimation |

| |  | Tim McDonnell |

| |

One of the biggest rooftop solar installers in the US, Freedom Forever, may be forced to “shrink back to the size of a mom and pop” if Congress approves a Republican plan to eliminate the tax credit that shaves up to 30% off the cost of household solar systems, a company’s executive warned.  Plans to kill the tax credit by the end of the year would be tantamount to a death sentence for much of the residential solar industry and bring major layoffs, Ben Airth, policy director at Freedom Forever, told Semafor. The Senate is expected to vote on the “One Big Beautiful Bill” as soon as this week, legislation that would scale back many tax benefits for clean energy, but hit rooftop solar especially hard. Analysts project that the measure would cause the amount of rooftop solar installed in the US to fall in 2026 by more than half compared with its 2024 level. “We’re in such limbo right now, and limbo is costing us jobs,” Airth said. “The industry will contract back to where it was in 2005.”

|

|

US forces COP30 ‘rethink’ |

| |  | Prashant Rao |

| |

COP30 President Ambassador André Corrêa do Lago. Andressa Anholete/File Photo/Reuters COP30 President Ambassador André Corrêa do Lago. Andressa Anholete/File Photo/ReutersClimate negotiators meeting at this year’s COP30 in Brazil must “rethink many things” as a result of the US withdrawal from the Paris Agreement, the summit’s president told Semafor in an interview. André Corrêa do Lago, a veteran diplomat and economist, acknowledged that “the fact that the US is leaving an agreement that was designed for the US to join is obviously something that obliged us to rethink many things.” His remarks come amid growing doubts among climate officials over whether the November talks will be successful. Businesses have also expressed concern over a lack of accommodation and infrastructure in Belém, the summit’s host city. He pushed back on those concerns, though: “There will be activities in Rio and São Paulo before Belém,” Corrêa do Lago said. “But we definitely want the actual agenda to happen in Belém, and we will find a way of doing it.” |

|

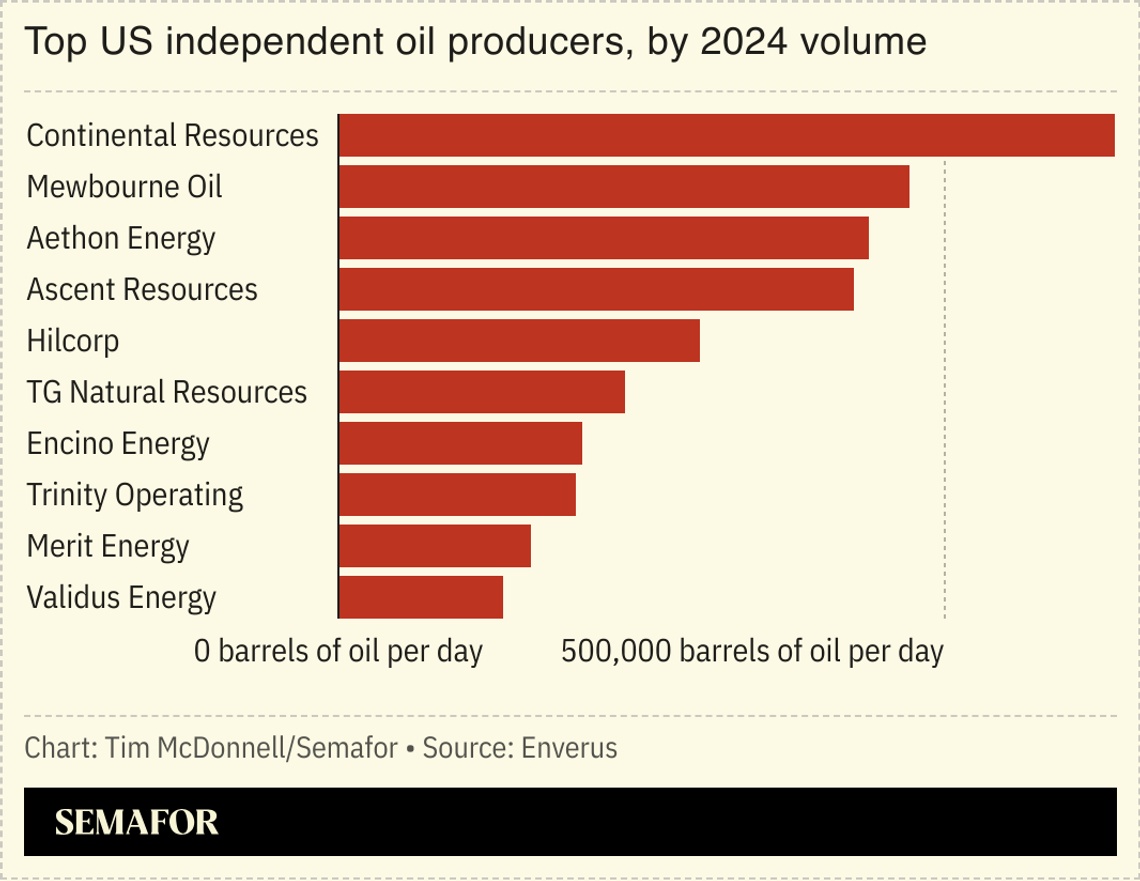

Shell denied that it is in talks to acquire BP. The Wall Street Journal reported Wednesday that negotiations for a sale are underway. Rumors have swirled for months that Shell could take advantage of BP’s poor performance over the last few years — linked to its loss of assets in Russia and an ill-fated foray into renewables — to snap up its smaller UK rival. A Shell spokesperson dismissed the Journal story as “further market speculation” and said no talks are underway.  The acquisition would make sense, said Andrew Dittmar, principal M&A analyst at the energy intelligence firm Enverus, although it could be better for Shell to bite off a select number of specific assets rather than buy the whole company, he said. But if Shell sees expanding its resource base as the key to better competing with Chevron and Exxon, there aren’t very many options aside from BP. And apart from Shell, there aren’t many potential buyers for BP: The US majors already have their hands full with mega-mergers, and UK regulators would frown on a sale to a Middle Eastern major, Dittmar said. |

|

Share of cars in Ethiopia that are EVs, by far the highest penetration rate in Africa. That figure is only slightly behind the US, and compares to less than 1% in Kenya. Ethiopia was once one of the least motorized countries in Africa, a study by the think tank Energy for Growth reported, but has leaped ahead on EVs by banning gas-engine vehicle sales and creating special tax incentives. But big challenges remain, since nearly half the country’s population lacks reliable access to electricity. |

|

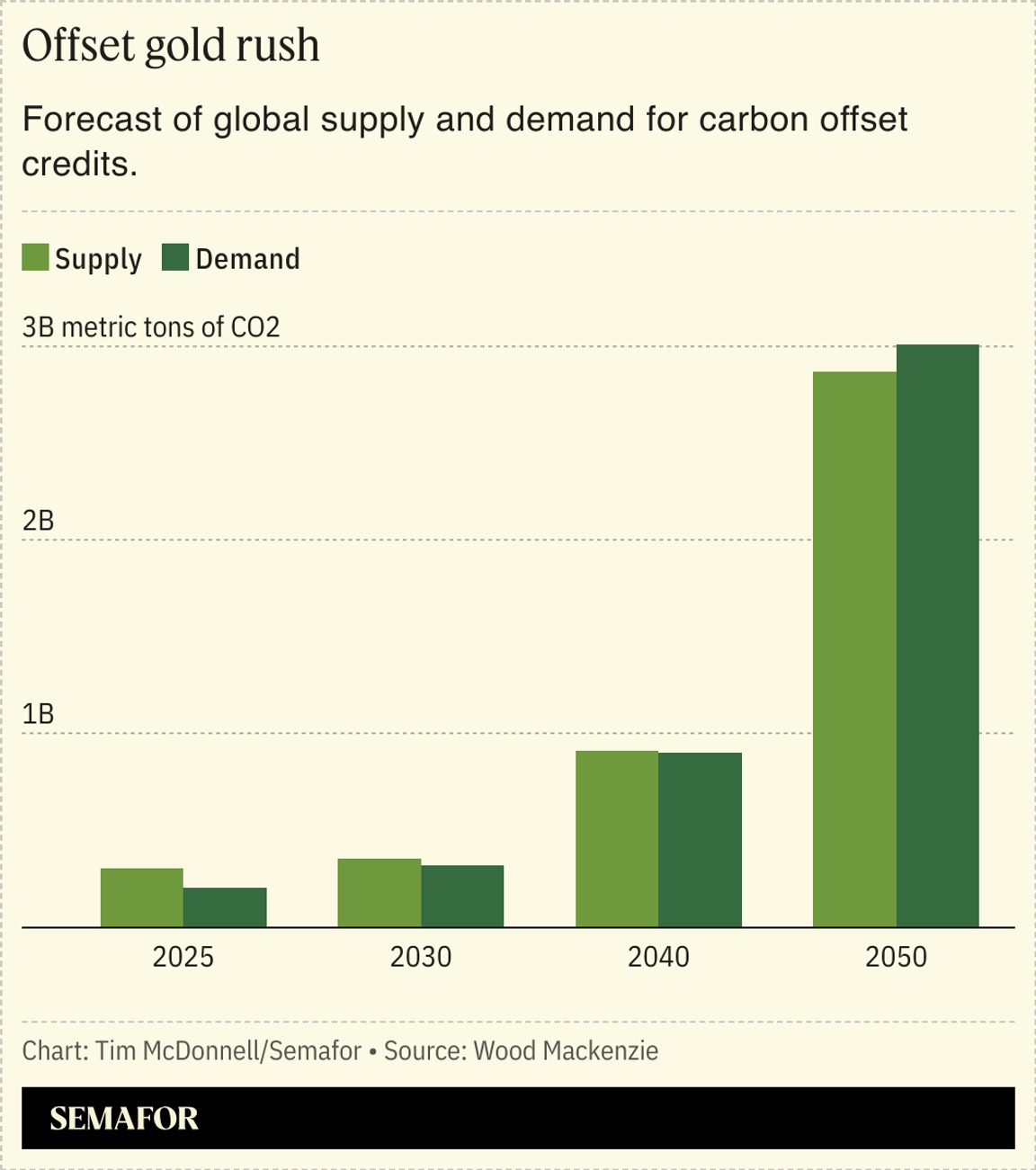

Bright future for offsets |

The global market for carbon offsets, which has been stagnant for the past couple of years, is likely to explode as corporate deadlines for midcentury net zero targets near, analytics firm Wood Mackenzie forecast.  As demand for credits outpaces supply, the average price per ton will rise from about $8 today to more than $55 by 2050, according to the forecast. Companies that anticipate needing to buy offsets, on top of or as an alternative to cutting their emissions directly, should line up projects early or risk being priced out. That’s especially true for high-quality carbon removal credits, which are in even shorter supply than conventional offsets; two of the most proactive buyers, Microsoft and JPMorgan, both announced new carbon removal purchase deals this week. But there are still plenty of low-quality, greenwashed offset credits circulating in the global market. And that puts companies at legal risk: A London School of Economics study this week found that lawsuits targeting the dubious use of carbon offsets are on the rise. |

|

New EnergyFossil Fuels TechEVsPersonnel- Spanish renewable energy giant Iberdrola named Pedro Azagra, head of its US division, as its new CEO.

|

|

Chris Gadomski, lead nuclear analyst at BloombergNEF.  |

|

Eduardo Munoz/Reuters Eduardo Munoz/ReutersNew York City’s business community — stunned by the apparent primary victory of socialist Zohran Mamdani and fearing a leftward shift in America’s biggest city — appears to be desperately organizing around Mayor Eric Adams in a last-ditch effort to block Mamdani in November’s general election, Semafor’s Ben Smith and Liz Hoffman reported. “There is going to be overwhelming support in the business community to rally around Adams,” said Richard Farley, a partner at Kramer Levin Naftalis & Frankel LLP who has been speaking with some of Cuomo’s biggest donors. “This will be a street fight all the way to November.” |

|

|