|

🚨 Big News!

I just launched the Compounding Dividends YouTube channel - today's post actually comes from there.

Quick favor:

👉 Click here to subscribe to the channel - it really helps a new channel like ours get off the ground.

And if you want to go the extra mile, watch a video or two to the end.

YouTube’s algorithm eats that up.

Here’s today’s article in video form:

Thanks for the support. Now, back to today’s issue:

👋 Howdy Partner,

What if you could steal a page from the playbook of one of the greatest investors alive - and use it to find high-quality, dividend-paying European stocks?

That’s exactly what we’re doing today.

We’re running Joel Greenblatt’s Magic Formula through a powerful screening tool - Fiscal.ai - across the Euronext and London Stock Exchange.

Who’s Joel Greenblatt?

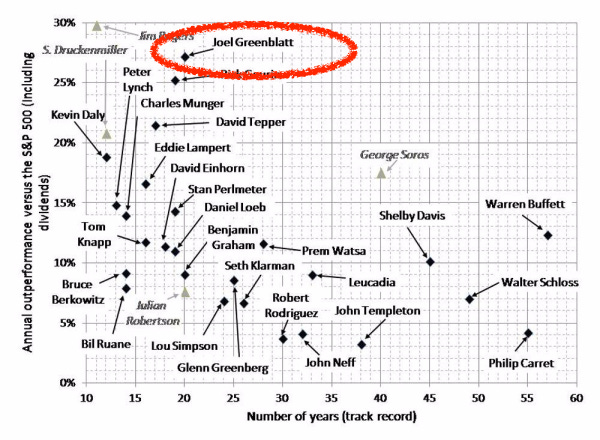

Joel Greenblatt is an investor, author, and professor at Columbia Business School, where he teaches value investing and entrepreneurship.

He also ran a hedge fund that delivered 40%+ annual returns for over 20 years.

His “Little Book That Beats the Market” contained a strategy that beat the market using just two metrics: Return on Capital and Earnings Yield.

He called it the ‘Magic Formula’.

Today we’re using Greenblatt’s Magic Formula, but I’m adding a twist: we’re filtering for dividend stocks only - because compounding income matters.

The Magic Formula

The screen looks for undervalued stocks with high returns on capital. Here's a simple breakdown of how it works:

Rank by Earnings Yield: Calculate the earnings yield of a company (this is basically the inverse of the P/E ratio). Rank stocks based on this yield; higher yields are better.

Rank by Return on Capital: Calculate the return on capital. Rank stocks again; higher returns are preferred.

Combine Rankings: Combine the two rankings for each stock. The goal is to find stocks that score well in both categories.

That’s the breakdown of the screening method. In the book, Greenblatt suggested you use this as a quantitative strategy. If you took this approach, you’d:

Select Top Stocks: Choose the top-ranked stocks from this combined list to invest in.

Hold for a Year: Maintain these investments for about a year, then repeat the process.

Our Screener Criteria

Here’s how I set up the Fiscal.ai screener:

Exchanges: The Euronext in Paris, Brussels, Amsterdam, and Lisbon, as well as the London Stock Exchange

5-yr Average ROCE: >8% I used a 5-year average to find companies with consistently high returns. I chose ROCE because it captures both debt and equity - we want companies that invest all of their capital wisely

Earnings Yield: >6%

Market Cap: > $1 billion

Dividend Yield: >2%